Andorra and South Korea sign the Double Taxation Agreement

Andorra and South Korea sign a Double Taxation Agreement that enhances fiscal cooperation and legal certainty between the two countries.

Reading time: 3 minutes

💡 Introduction

The Principality of Andorra and the Republic of Korea have signed a Double Taxation Agreement (DTA), a milestone aimed at eliminating double taxation, preventing tax evasion, and fostering greater legal and fiscal cooperation between the two nations.

The treaty entered into force on 1 April 2025, following the diplomatic exchange of notifications, and was officially published in the BOPA on 9 April 2025, granting it full validity under Andorran law.

⚖️ 1) How the agreement was reached

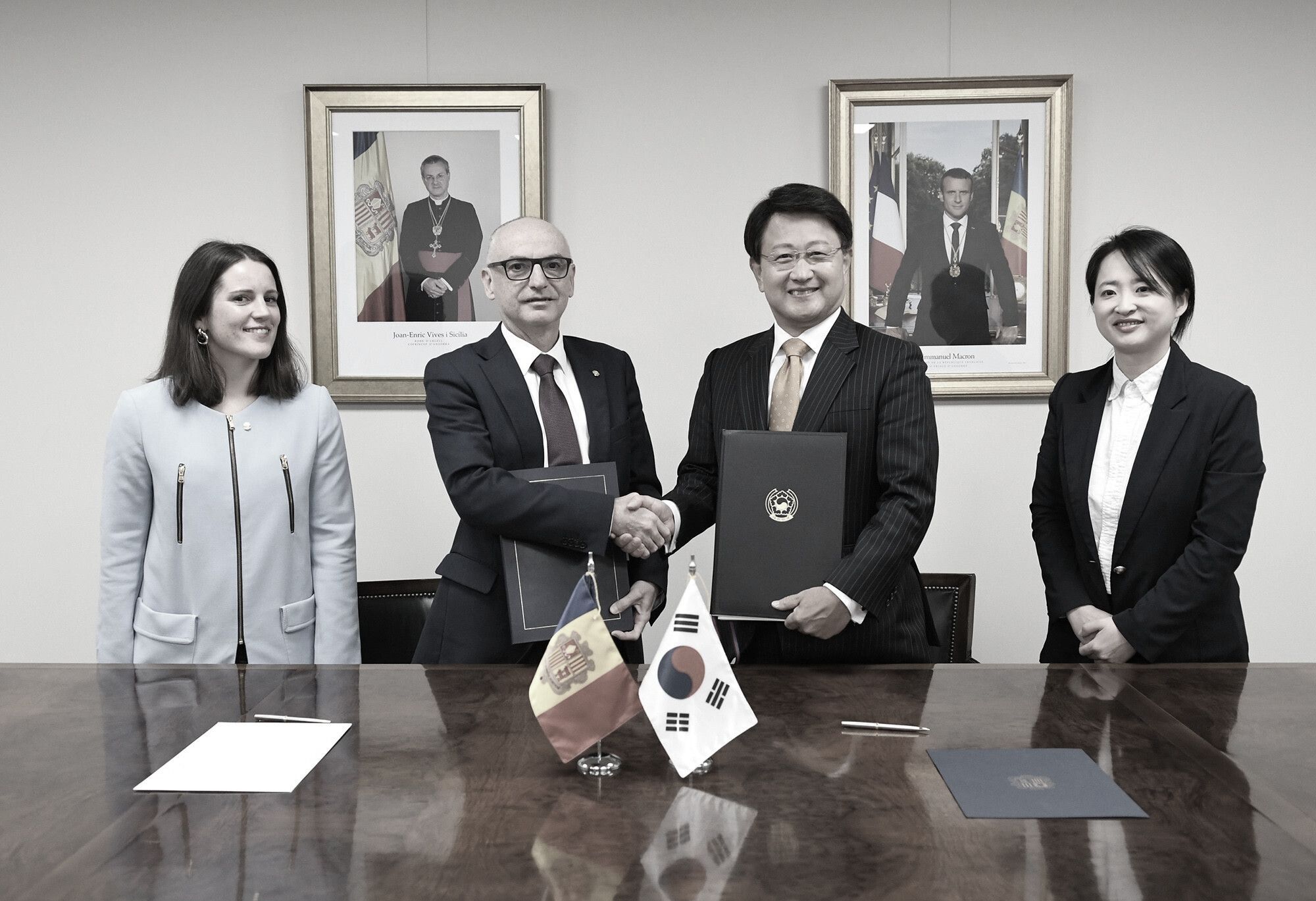

The Agreement between the Principality of Andorra and the Republic of Korea was signed in Andorra la Vella on 3 November 2023 by:

- Ramon Lladós Bernaus, Minister of Finance of the Andorran Government.

- Bahk Sahnghoon, Ambassador of South Korea accredited to Andorra.

Negotiations took place between December 2022 and March 2023, as part of Andorra’s international effort to expand its tax treaty network.

The Consell General ratified the text on 15 July 2024, and it was published in the BOPA No. 87 on 7 August 2024.

Following the exchange of diplomatic instruments, the treaty entered into force on 1 April 2025, and was published officially on 9 April 2025, confirming its enforceability in Andorra.

🧩 2) Key provisions of the DTA

Based on the OECD Model Convention, the treaty includes provisions that promote fairness, transparency and cooperation in taxation.

Main highlights include:

- Tax residency rules: criteria to determine where individuals and entities are taxable.

- Methods to avoid double taxation: tax credits or exemptions for taxes paid in the other country.

- Exchange of tax information: strengthened cooperation between tax authorities.

- Anti-abuse clauses: measures to prevent treaty shopping or artificial arrangements.

The agreement also covers dividends, interest, royalties, capital gains and pensions, enhancing legal certainty and fiscal stability for cross-border transactions.

➤ To understand how Andorra’s tax treaties are structured and which countries have active agreements, you can read the article Double Taxation Treaties (DTTs) in Andorra.

🕊️ 3) Entry into force

According to Article 27 of the Agreement, the DTA entered into force on 1 April 2025 upon completion of the diplomatic exchange of notifications.

Its official publication in the BOPA on 9 April 2025 granted it full effect under Andorran domestic law.

The treaty will apply for tax purposes:

- To withholding taxes on income paid or credited from 1 January 2026, and

- To income taxes for fiscal years beginning on or after 1 January 2026.

🌍 4) Importance of the agreement

Although economic relations between Andorra and South Korea are still limited, this treaty strengthens Andorra’s position as a transparent and internationally aligned jurisdiction.

Key implications:

- For Andorra: expands its network of tax agreements and global credibility.

- For South Korea: enhances investor confidence in cross-border activities.

- For companies and individuals: provides protection against double taxation and promotes bilateral trade.

The DTA aligns with Andorra’s ongoing commitment to OECD standards and the BEPS initiative.

➤ If you’d like to gain a clearer view of Andorra’s tax system and its competitive advantages, we recommend reading Taxation in Andorra: structure, rates and real advantages.

➤ You may also be interested in Tax residency in Andorra: requirements and benefits (2025).

Conclusion

The Double Taxation Agreement between Andorra and South Korea marks another step in Andorra’s global fiscal integration.

From 2026 onward, it will provide a clear, stable and cooperative framework for businesses, investors and professionals operating between the two countries.

If you have any questions, feel free to contact us through the contact form.

Last revision date: October 2025