Living and working in Andorra: what you need to know before relocating

Living and working in Andorra means safety, low taxes and quality of life. Learn what you need to know before relocating in 2025.

Reading time: 6 minutes

Before moving to Andorra: what you need to understand from the outset

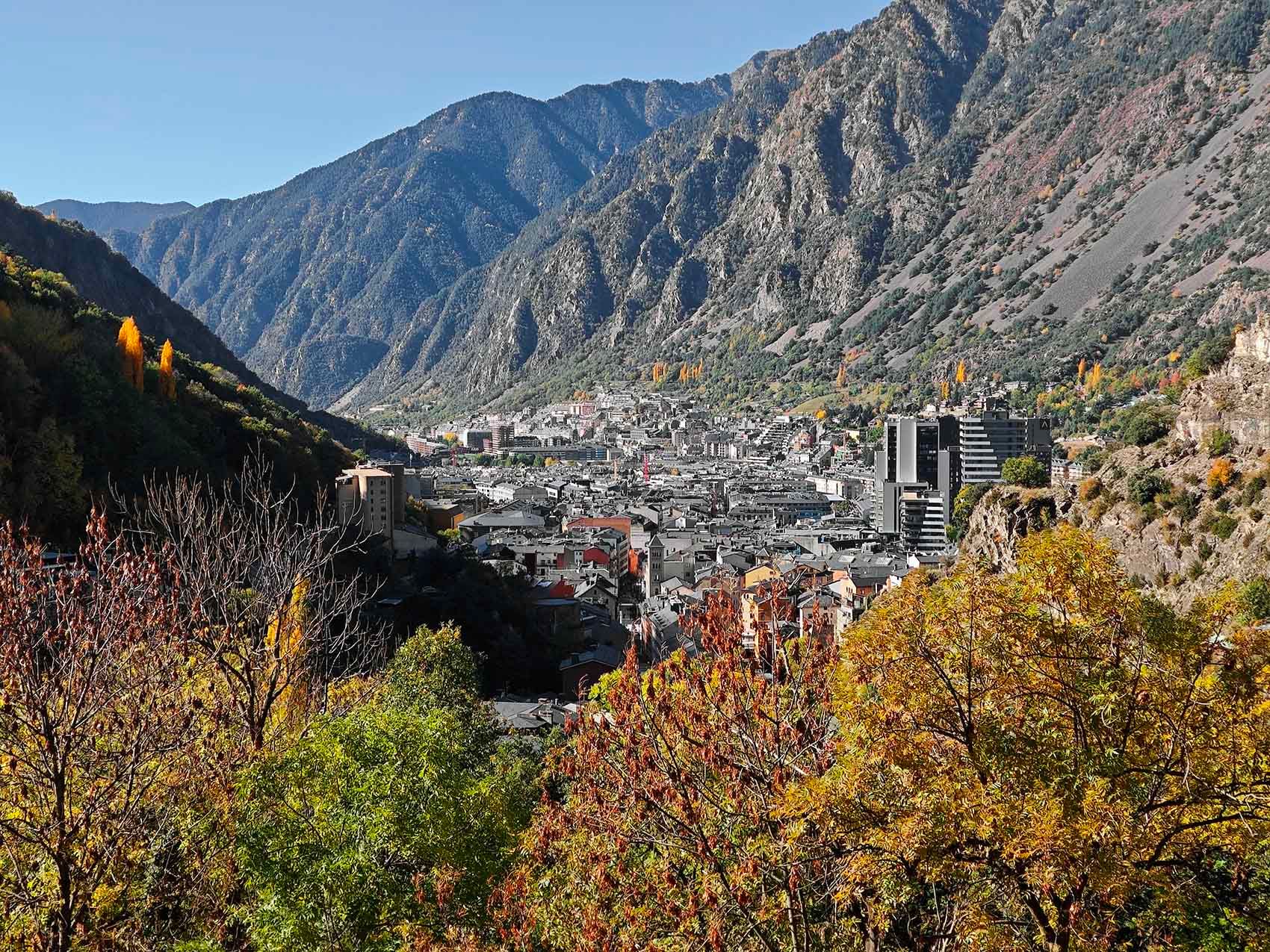

Andorra has become one of Europe’s most appealing destinations for those seeking security, quality of life, nature and a competitive tax system.

However, moving here to live and work requires careful preparation: residence, taxation, social security, banking, housing, lifestyle, languages and transport.

This article gathers the essentials — updated for 2025 — to help you assess whether this move aligns with your personal and professional goals.

Residence: active and passive

Andorran law distinguishes between active residence (employed or self-employed) and passive residence (without local economic activity).

To work or operate a business, you need active residence; passive residence is for investors or financially independent individuals.

Authorities have tightened entry quotas, so advance planning and complete documentation are key.

To explore this distinction in more depth, we recommend the article Active vs passive residence in Andorra: key differences and how to choose the right option.

Personal and corporate taxation

The Personal Income Tax (IRPF) has a flat nominal rate of 10 %, with lower effective rates on smaller incomes:

- Up to €24,000 – 0 %

- €24,000–€40,000 – 5 %

- Above €40,000 – 10 %

The Corporate Income Tax is also set at 10 %, among the most competitive in Europe, and Andorran dividends are exempt.

In international structures, analysing double-tax treaties and effective tax residence is essential to avoid conflicts.

If you are looking for a general overview of Andorran taxation, we recommend the article Taxation in Andorra: structure, tax rates and real advantages.

Social security and healthcare

All active workers must register with CASS (Caixa Andorrana de Seguretat Social), covering healthcare, pensions, disability and maternity.

In addition, Andorra maintains healthcare agreements with Spain and France, providing cross-border coverage of high quality.

➡️ See the article on the CASS and contributions in order to get more information abotu the security system of Andorra.

If, on the other hand, you wish to gain a deeper understanding of the Andorran healthcare system, we recommend reading Healthcare in Andorra: how it works and what it really covers.

Labour market and minimum wage

For 2025, the minimum monthly wage is €1,447.33 (≈ €8.35/hour) under Decree 4/2025, while the average wage is around €2,500.

Qualified sectors — notably tech, finance and consulting — offer significantly higher pay levels.

Private banking and investment

Opening a standard bank account is straightforward, but access to private banking requires investments between €500,000 and €1 million, depending on the bank and services.

These clients enjoy dedicated wealth managers and advanced international tax and estate planning tools.

Learn more about the Andorran banking system in Andorra’s banking system: local banks, financial regulation and international presence.

Housing, transport and connections

The Andorran real estate market is tight and in high demand, particularly in Escaldes and Andorra la Vella.

It’s advisable to secure rental or purchase agreements early, as high-quality properties are limited.

Andorra lacks a train network or major airport, but the La Seu d’Urgell Airport and regular bus services connect with Barcelona and Toulouse (≈ 2 hours).

Its location offers convenient links while maintaining a peaceful mountain environment.

➡️ See the article on housing in Andorra so to have a clear idea about the real estate market in Andorra.

Climate, nature and active leisure

Andorra enjoys a stable, sunny climate most of the year, with mild winters and temperate summers.

Over 90 % of its territory consists of forests and mountains, offering hundreds of hiking and trekking trails, via ferratas, climbing areas, MTB routes and legendary cycling roads, featured in the Tour de France and Vuelta a España.

The country combines nature with a rich cultural and commercial life – restaurants, boutiques, duty-free shopping, theatre, opera, bowling and casino.

Hosting 8–10 million visitors annually, Andorra stands out for its vibrant and sophisticated lifestyle.

In the article Climate in Andorra: clean air, four seasons and quality of life, you can review everything you need to know about the climate of this Pyrenean country.

Education and languages

The education system is distinctive: three public networks coexist — Andorran, Spanish and French — plus international schools with bilingual or British curricula.

Main languages :

- Catalan – official and administrative language.

- Spanish – widely spoken daily.

- French – strong cultural presence.

- English – expanding, especially in education and business.

This multilingual environment ensures smooth integration for international families and professionals.

➤ To better understand how Andorra’s education system works and how its three public models coexist, you can read the article Education in Andorra: a unique trilingual coexistence system.

Safety and institutional stability

Andorra offers exceptionally low crime rates and a stable institutional framework.

Property rights are highly protected: no illegal occupations and no homelessness or street begging are allowed.

This combination of security, discretion and neutrality makes Andorra one of Europe’s most reliable jurisdictions.

Now that you are familiar with the key aspects, if you would like to go further, you can read Living in Andorra: the essential guide to obtaining residence and settling securely.

A life decision that requires careful planning

Living and working in Andorra provides a rare balance – natural surroundings, competitive taxation, efficient healthcare, multilingual education and legal certainty.

Proper planning — residence type, fiscal matters, housing — is essential for a smooth transition.

With the right guidance, it can be one of the most rewarding decisions of your life.

📞 Do you need professional advice or support to take the next step?

First, we recommend continuing to explore our publications section, where you will find answers to the most common questions.

If you prefer, you can book a consulting meeting just below this article, or contact us through our form to share your questions and concerns.

Last revision date: January 2026

Technical Author: Albert Contel