Residency in Andorra for retirees: real requirements, limitations and alternatives

Residency in Andorra for retirees: real requirements, limits and the advantages of a safe, peaceful country with a healthy climate, excellent healthcare and a competitive tax system.

Reading time: 7 minutes

A residency designed for those seeking peace, security and quality of life

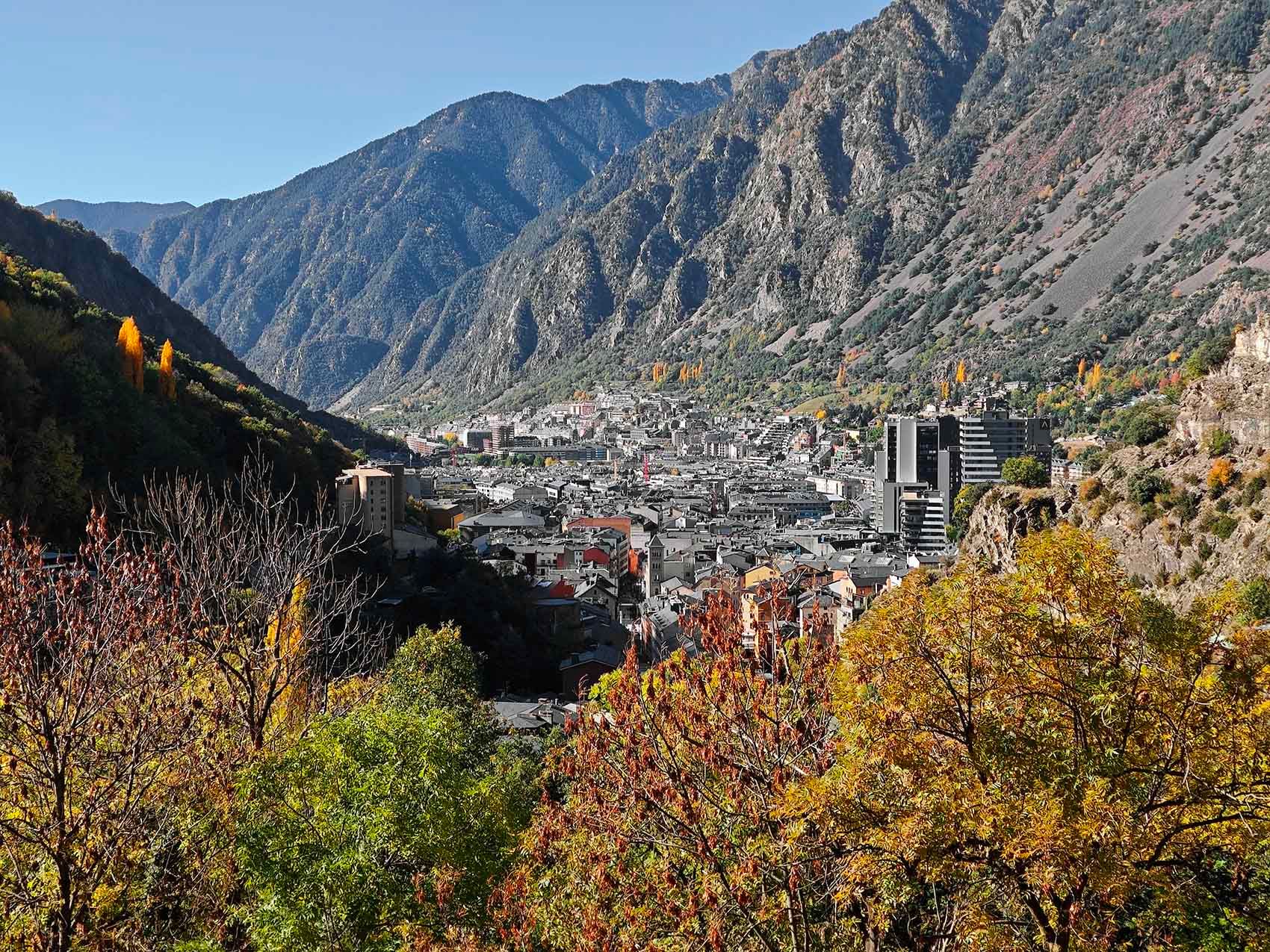

Andorra has become one of the preferred destinations for European retirees looking for tranquillity, virtually non-existent crime, a calm rhythm of life and a genuinely safe environment.

The country offers clean air, a healthy mountain climate, mild summers, and a modern, fast and accessible healthcare system. Its political stability and cultural proximity to Spain and France make it especially appealing.

That said, there is no specific “retiree residency”. The suitable route is passive residency, intended for financially solvent individuals with no professional activity who wish to settle in a country known for its exceptional quality of life.

➤ To understand the overall residency framework, see Types of residency in Andorra: active, passive and tax residency

Passive residency: the natural route for retirees

Passive residency fits the profile of a retiree for three reasons:

- It does not allow economic activity.

- It requires financial capacity and a real link to Andorra through investment.

- It offers access to a highly competitive tax system (maximum 10%).

➤ For a full overview, see Passive residency in Andorra: evolution, requirements and legislative changes

🔹Main requirements (2025)

A retiree applying for passive residency must provide:

- Guarantee deposit: €50,000 with the AFA.

- €12,000 for each dependent.

- Minimum investment of €600,000 in Andorran assets.

- Minimum effective presence: 90 days per year.

- Full private health insurance.

- Sufficient economic means (pension income, savings, or returns).

- Clean criminal record.

- Accommodation in Andorra (ownership or rental).

Some of these requirements derive from Law 5/2025 (“Omnibus Law”) and Decree 76/2024.

What a retiree can and cannot do under passive residency

This is often misunderstood, especially by retirees wishing to remain “active”.

✔️ What passive residents are allowed to do

- Live legally in Andorra.

- Own an Andorran company.

- Employ staff in that company.

- Manage personal assets, investments and portfolio.

- Receive dividends, financial returns or passive income.

❌ What passive residents are not allowed to do

- Work in Andorra.

- Be a remunerated company administrator.

- Issue invoices or provide services.

- Carry out any economic activity, even occasionally.

- Contribute to CASS.

➤ To understand how Andorra’s social security works, see CASS in Andorra: contributions, coverage and key points for 2025

What if a retiree wants to keep working or contributing?

Many retirees wish to:

- carry out occasional professional activity;

- receive income for specific services;

- take part in the management of a company;

- contribute to CASS to maintain social coverage.

Passive residency does not allow this.

🔹Option 1 — Self-employment residency

The natural alternative when the person:

- owns a company;

- wishes to exercise real managerial or executive functions;

- intends to receive employment-related income;

- needs to contribute to CASS.

Essential conditions:

- Minimum 35% shareholding.

- Being an administrator with effective functions.

- €50,000 deposit with the AFA.

- Minimum 183 days of residence per year.

- CASS contributions as a self-employed worker.

➤ You can read more in Self-employment residency in Andorra: requirements, advantages and real taxation

🔹Option 2 — Employment-based residency

Only possible if an Andorran company hires the retiree.

Uncommon, but viable.

What a retiree should evaluate before deciding

Many retirees make the decision based on quality-of-life considerations:

- Am I looking for an extremely safe country?

Andorra has one of the lowest crime rates in Europe. - Do I want real tranquillity, without crowding or stress?

Calm routines, social order, and a peaceful environment. - Do I value clean air and a healthy climate?

Mild summers and pure mountain air are highly appreciated. - Do I need fast access to healthcare?

Andorra’s healthcare system is known for speed and efficiency. - How many days can I spend in the country?

Passive residency requires 90 days; tax residency requires 183.

➤ For details on tax residency rules, see Tax residency in Andorra: requirements and real advantages

Real advantages for retirees

This residency type offers benefits particularly valued during retirement:

- Exceptional safety and almost non-existent crime.

- Calm lifestyle and welcoming environment.

- Excellent and accessible healthcare.

- Healthy mountain climate.

- Competitive taxes (max. 10% IRPF).

➤ For further fiscal insight, see Taxation in Andorra, and also How financial income is taxed in Andorra

- No wealth tax.

- No inheritance or gift tax.

- Quick access to France and Spain.

- High day-to-day quality of life.

For many retirees, this balance of peace, health, safety and competitive taxation is unmatched in Europe.

When passive residency is NOT suitable

It is better to consider another residency type if the person:

- wishes to carry out professional activity;

- wants to receive a salary;

- intends to be a remunerated administrator;

- does not want to immobilise €600,000;

- needs to contribute to CASS;

- cannot spend 90 days per year in Andorra.

In summary

For retirees, Andorran residency is usually obtained through passive residency, a permit that:

- does not allow work or invoicing;

- does not allow remunerated directorship;

- does allow living, investing and managing personal wealth;

- requires solvency and a real economic link to the country.

For those seeking safety, stability, a healthy climate and reasonable taxation, it is an excellent route.

For those wishing to remain professionally active, other options fit better.

📞 Need personalised guidance?

If you would like to assess which residency type best matches your personal situation, you may book a meeting or contact us here.

Last updated: January 2026

Technical Author: Albert Contel